Environmentally related taxes

Green taxation is an instrument that can be used to influence or change our behaviour and as a guide in sustainable development. The purpose of environmental taxes, which are considered to be part of environmental subsidies and similar transfers, is to steer both producers and consumers towards a limitation or reduction of their production or consumption of goods that pollute the environment, and thus encourage them to use natural resources responsibly.

From the amount of revenue generated from environmental taxes, however, we cannot draw any conclusions about the steering effect of environmental taxes. A large amount of revenue raised through environmental taxes may either come from a high taxation of products which cause environmental damage (irrespective of the motivation behind such tax systems) or from the fact that such products (although lower-taxed) are heavily used. A combination of both effects is also possible.

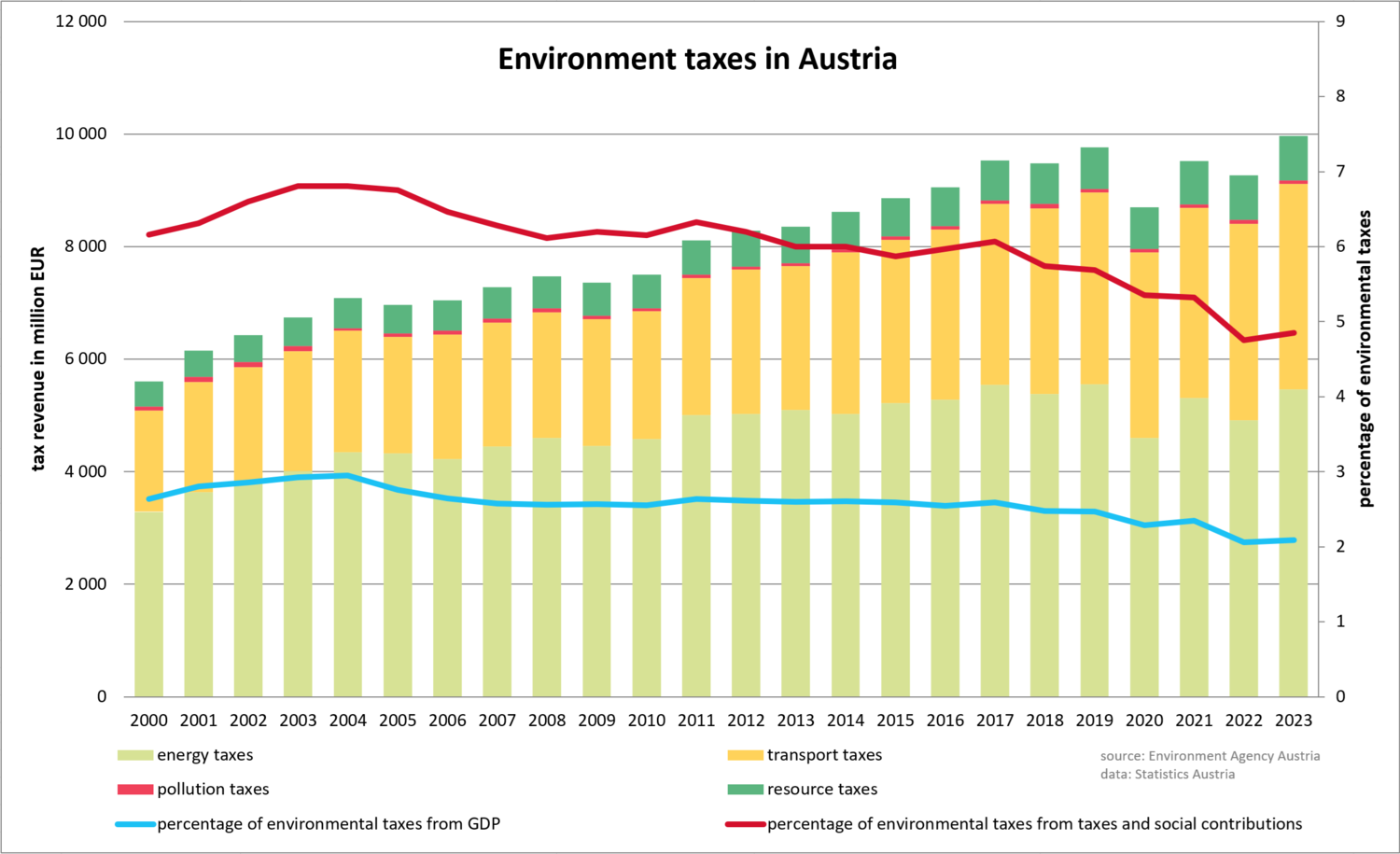

At international level, a harmonised system for recording environmental taxes has been developed in OECD and Eurostat working groups with member and partner countries. The following main groups of environmental taxes have been defined:

- energy taxes

- transport taxes

- taxes on environmental pollution

- taxes relating to resources

These environmental taxes include taxes on vehicles, landfill taxes and taxes on emissions to air and water.

Other ecologically relevant payments (fees and charges) are not included in the above list, since they do not constitute taxes within the meaning of the SNR. As opposed to taxes, fees and charges (e.g. waste charges) are earmarked for a special purpose, which means that people pay them in return for a public service they receive. Because of their "ecological accuracy", fees and charges are ecologically more significant than taxes.

The ecologically relevant payments consist of the waste, sewage and water charges, the sale of the motorway vignette, truck road pricing, tolls and the parking meter fee in Vienna.