Environmentally related transfers

Environmentally-related transfers have been attracting more and more interest at national and international level in recent years. Environmentally-related transfers include:

- environmental taxes (eco taxes)

- environmental subsidies

- other transfers of environmental relevance

While a standard definition of environmental taxes or eco-taxes has been available at international level (EU, OECD) for quite a long time, there is no such definition for other fees or charges. Two processes which are of relevance for Austria and Europe are currently underway at international level with the aim to standardise and expand reporting on environmentally-related transfers:

The “Eurostat Task Force on Environmentally-related Transfers” had the main task to suggest standard definitions for environmentally-related subsidies and to expand environmental taxes by introducing other ecologicallly relevant fees or charges.Based on the results of this task force, a questionnaire was developed that currently records environmentally friendly subsidies and other transfers on a voluntary basis.In a next step, this questionnaire is to be expanded to include potentially environmentally harmful subsidies and transfer payments.

For years, the OECD has been conducting research on economic instruments which are ecologically effective on the one hand and economically efficient on the other, e.g. taxes and tradable allowances (greenhouse gas emission allowances). In a joint effort, the United Nations, the European Commission, the International Monetary Fund – together with the OECD and the World Bank - have revised the Handbook of National Accounting: Integrated Environmental and Economic Accounting 2003, commonly referred to as SEEA 2003. After a final global consultation process, the revised SEEA Central Framework was adopted by the UN Statistics Commission in 2012 as the first international standard for environmental accounts and published in its final version in 2014. It describes methods which can be used to produce environmental accounts, and it includes environmentally-related transfers, which were added during the revision process.

"Environmental taxes" follow a standardised definition (European Commission, OECD and International Energy Agency, 1998). According to this definition, an environmental tax is a tax whose tax base is a physical unit (or a proxy of it) of something that has a proven, specific negative impact on the environment, such as a process or a product which pollutes the environment, threatens natural resources or uses non-renewable resources.

Environmental taxes are classified into four groups:

- Energy taxes

- Transport taxes

- Resource taxes

- Pollution taxes

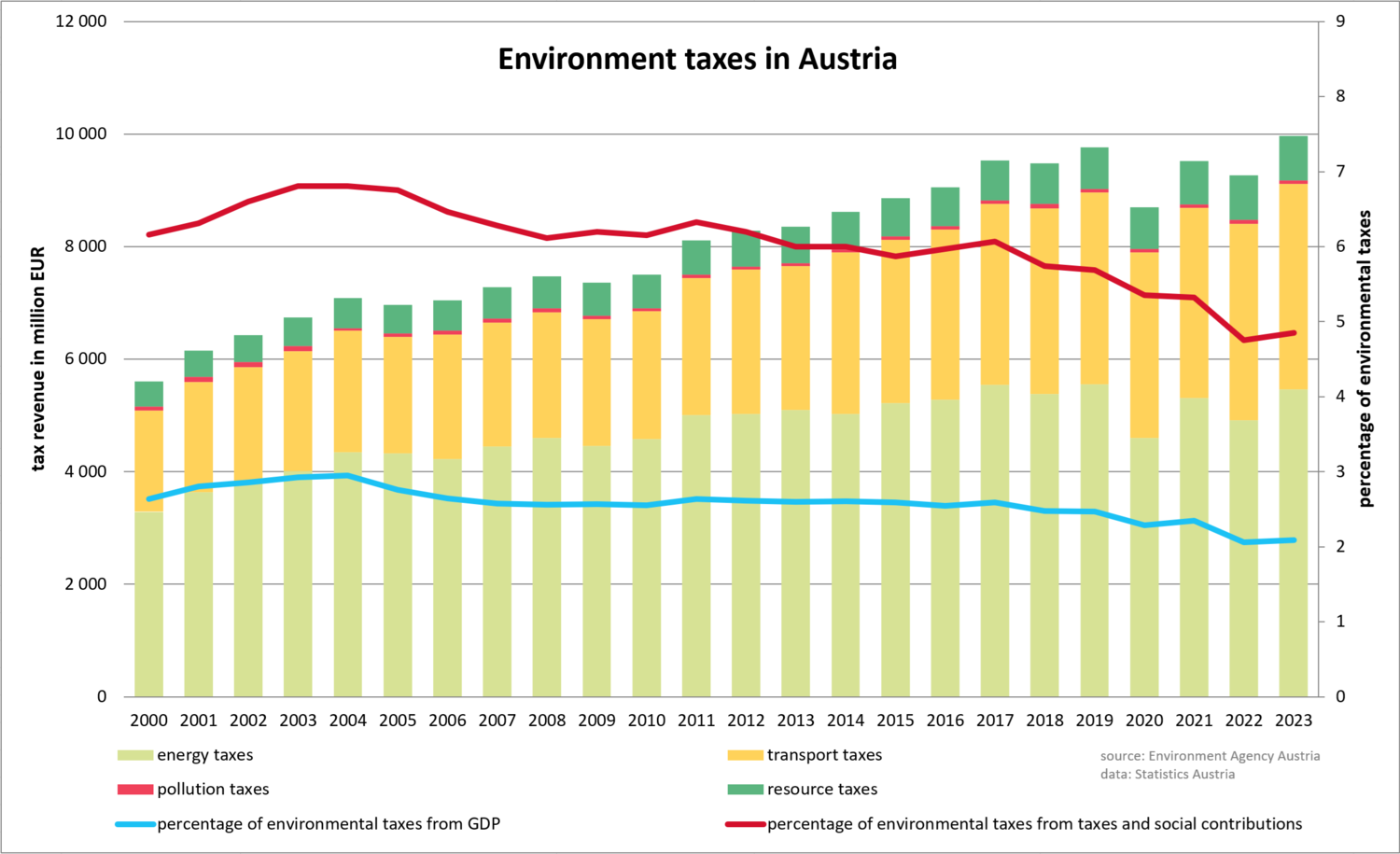

The following graph shows the trends for these four groups of environmental taxes in Austria over the last few years.

In addition, there are other fees and charges which are becoming increasingly important and whose base is also a physical unit of something that has a proven, specific negative impact on the environment. These are not taxes according to the national accounts, which is why it is not appropriate to consider them as such. In Austria they are referred to as other transfers of environmental relevance. These include, amongst others, water and wastewater rates, parking fees and income generated from vignettes for using motorways or HGV road pricing.

“Environmental subsidies " consist of both environmentally motivated (environmentally friendly) and potentially environmentally damaging subsidies.

Environmentally motivated subsidies are all subsidies whose motive is environmental protection. The motivation implies that they are seen as environmentally friendly. Austria is represented on the Eurostat Task Force on Environmentally-related Transfers through Statistics Austria and thus involved in the development of a common European method for collecting (and analysing) data on these subsidies.

The same applies to potentially environmentally harmful subsidies, the identification, recording and evaluation of which is planned in a next step.

Connection with a greener tax system

To put sustainability, a concept which has acquired high priority both within the European Union and in Austrian environmental policy since the Earth Summit in Rio de Janeiro in 1992, into practice and to implement other environmental policy targets, there are, time and again, discussions about a greener tax system. With a greener tax system, it is hoped that a true cost accounting regime can be achieved in the use of environmental resources, as well as a steering effect which helps to increase our care about and awareness of the environment. A green tax reform is also one of targets specified in the Austrian sustainable development strategy.

Before undertaking international efforts to bring about a green tax reform, a comparable database on environmental taxes had to be created in the individual countries. For this purpose, a joint project was carried out by the European Commission, the International Energy Agency and the OECD in 1998 to prepare a standard framework which currently provides the basis for the calculation and representation of environmental taxes.

As a next step, and with a view to true cost accounting and steering effects, it is planned to expand environmental taxes at European level by including the topics ‘environmentally motivated subsidies’ and ‘potentially damaging subsidies’, as well as ‘other environmentally relevant subsidies’.